Introduction: Why the New Tax Regime Matters

If there’s one topic that’s trending every tax season, it’s the New Tax Regime. With the government pushing for simplification of income tax in India, millions of salaried individuals and business owners are asking the same question:

👉 Should I switch to the new tax regime or stay with the old one?

The Finance Ministry has made the new regime the default system in FY 2023–24, but taxpayers still have the option to choose. Let’s decode everything you need to know about the New Tax Regime 2025, slab rates, pros & cons, and practical tips.

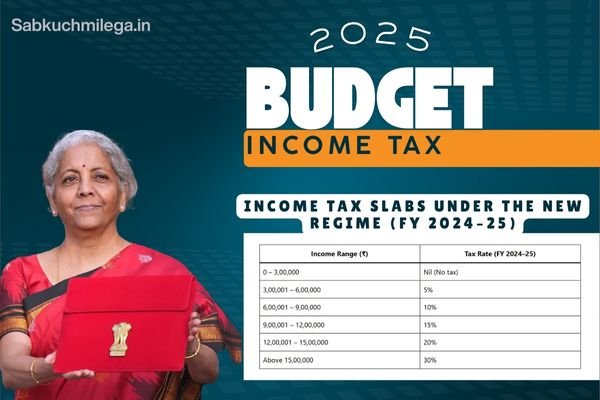

📊 Income Tax Slabs Under the New Regime (FY 2024–25)

Here’s the latest tax slab structure under the new regime:

| Income Range (₹) | Tax Rate (FY 2024–25) |

|---|---|

| 0 – 3,00,000 | Nil (No tax) |

| 3,00,001 – 6,00,000 | 5% |

| 6,00,001 – 9,00,000 | 10% |

| 9,00,001 – 12,00,000 | 15% |

| 12,00,001 – 15,00,000 | 20% |

| Above 15,00,000 | 30% |

✅ Under Section 87A, individuals with income up to ₹7 lakh are eligible for full rebate, meaning zero tax liability.

🆚 New Tax Regime vs Old Tax Regime

| Feature | New Tax Regime | Old Tax Regime |

|---|---|---|

| Tax Slabs | Lower rates, more slabs | Higher rates, fewer slabs |

| Deductions & Exemptions | Not available (mostly removed) | Over 70 deductions/exemptions |

| Rebate (Section 87A) | Up to ₹7 lakh | Up to ₹5 lakh |

| Standard Deduction | Available (₹50,000) | Available (₹50,000) |

| Default Option | New regime (since 2023) | Opt-in basis only |

| Suitable For | Those with fewer investments | Those claiming deductions heavily |

💡 Tip: If you claim HRA, 80C, 80D, home loan, and other deductions, the old regime may still save you more.

✅ Advantages of the New Tax Regime

- Lower tax rates for most income levels.

- Simplified filing – no need to track multiple exemptions.

- Better for freshers & young professionals who don’t have big investments.

- More take-home salary for those without heavy tax-saving instruments.

⚠️ Disadvantages of the New Tax Regime

- No deductions under 80C (PF, ELSS, LIC), 80D (Health Insurance), or HRA.

- Not beneficial for individuals with home loans or large tax-saving investments.

- Removes the tax incentive for savings & insurance, which may reduce long-term wealth creation.

💡 Who Should Choose the New Tax Regime?

The new tax regime benefits:

- Young earners with lower salaries who don’t have investments yet.

- Freelancers & gig workers who don’t get HRA or structured salary benefits.

- Senior citizens with straightforward income sources (like pension).

- Individuals with income under ₹7 lakh, thanks to the rebate.

🔢 Practical Example: Tax Comparison

👉 Salary = ₹12,00,000 annually

- Old Regime (with deductions):

- Investments under 80C (₹1.5L), health insurance under 80D (₹25k), HRA, etc.

- Effective tax = around ₹80,000–90,000.

- New Regime:

- No exemptions.

- Effective tax = around ₹1,20,000–1,25,000.

✅ If you claim deductions, the old regime wins. Without deductions, the new regime is better.

📌 FAQs

Q1. Is the New Tax Regime mandatory in 2025?

No. It is the default regime, but you can opt for the old regime when filing your return.

Q2. Can I switch between regimes every year?

Salaried employees can switch every year, but business professionals can only opt once.

Q3. Does the new tax regime allow HRA or 80C deductions?

No, most exemptions are removed. Only NPS (80CCD (2)) and a few are allowed.

Q4. What is the rebate limit in 2025?

Under Section 87A, incomes up to ₹7 lakh enjoy full rebate = zero tax.

Q5. Which is better – old or new regime?

It depends on your investments. If you invest in tax-saving options, old regime works better. If not, the new regime saves more.

🎯 Conclusion: Simplification vs Savings

The New Tax Regime 2025 is the government’s attempt to simplify taxation for the common man. It works best for those with minimal investments and straightforward incomes. However, taxpayers with significant deductions and exemptions may still benefit more from the old regime.